Rental property amortization schedule

Related to Amortization Rent. How do I expense the remaining amortization of loan fees points on a rental property Schedule E.

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

From within your TaxAct return Online or Desktop click Federal.

. As a general rule the IRS classifies rental income as passive income and taxes it accordingly. Report income and expenses related to personal property rentals on Schedule C Form 1040 PDF if youre in the business of renting personal property. Amortization rate means the amortization rate as defined in Section 49-11-102 to be applied to the system that would have covered the retiree if the.

In step-by-step go to the page for the specific rental property ie 1234 Maple Street. The confidentiality of your financial information is important to us and were committed to keeping it secure. Publication 527 2018 Residential Rental Property.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. 3525 Piedmont Rd NE 8 Piedmont Center - Suite 600. 4 Shore Tents and Party Rentals 10865 Greensboro Road Denton MD 21629.

Maryland Tents and Party Rental Cities. Buy or sell your home with Long Foster. Our amortization calculator will do the math for you using the following amortization formula to calculate the monthly interest payment principal payment and outstanding loan balance.

Find an agent who specializes in luxury real estate. You can add another asset in the Rental Real Estate section and. The upper half of the screen is for income for that rental property the bottom half for.

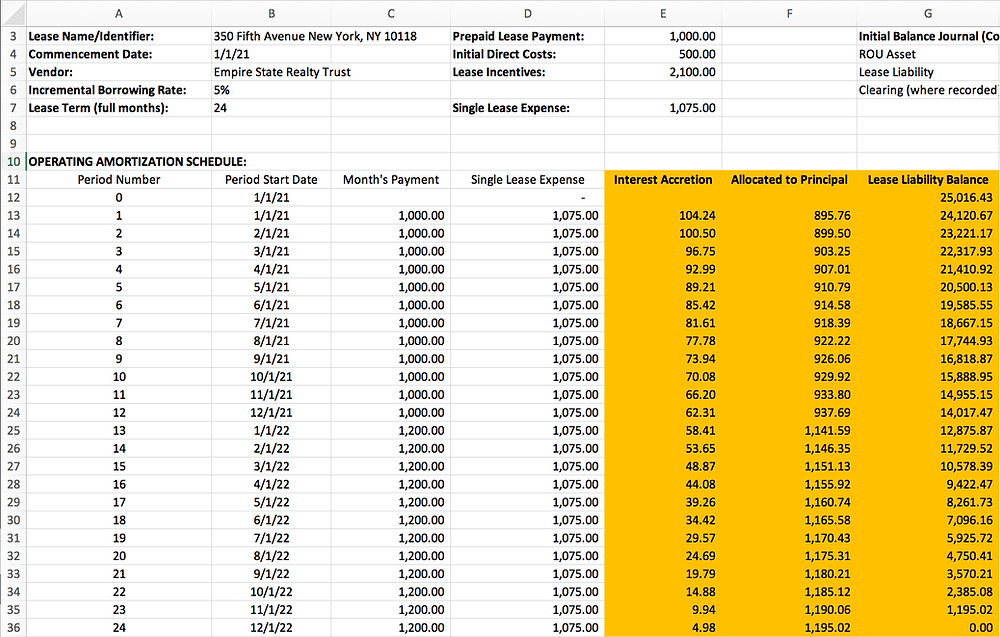

On smaller devices click in the upper left-hand corner then click. Residential rental property. In our lease amortization schedule excel spreadsheet there are primary inputs that drive the initial recognition of your lease liabilities under the new lease accounting.

Uses mid month convention and straight-line. We keep your information safe through Transport Layer. That means you pay taxes on it at your regular income tax rate between 10-37.

Rental Guide Tips Rental Policies. Click Rent or Royalty Income in the Federal Quick QA Topics menu to expand the category and then click Real estate rental income. This class includes any real property that is a rental building or structure including a mobile home for.

To enter the points into the TaxAct program. Click Add Federal Schedule E to create a new copy of. Search luxury homes and mansions for sale in MD VA DC.

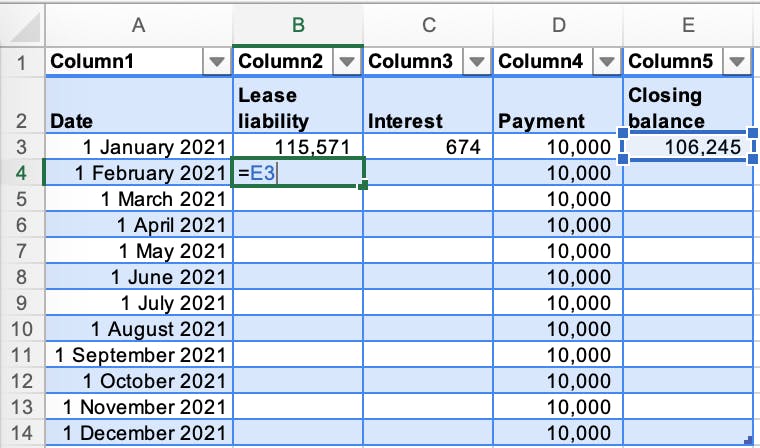

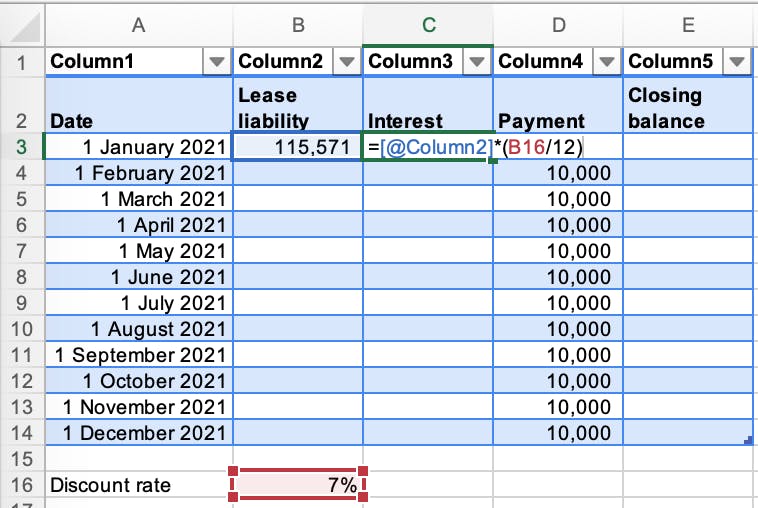

Lease Liability Amortization Schedule Calculating It In Excel

Amortization Vs Depreciation What S The Difference My Tax Hack

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

Definition Of Amortization Schedule Chegg Com

How To Calculate A Monthly Lease Liability Amortization Schedule In Excel

A Guide To Property Depreciation And How Much You Can Save

Depreciation Schedule Template For Straight Line And Declining Balance

What Is Schedule E What To Know For Rental Property Taxes

Asc 842 Lease Amortization Schedule Templates In Excel Free Download

Part 2 How To Prepare A 1040 Nr Tax Return For U S Rental Properties

4562 Listed Property Type 4562

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Lease Liability Amortization Schedule Calculating It In Excel

Rental Property Depreciation Rules Schedule Recapture

How To Calculate A Monthly Lease Liability Amortization Schedule In Excel

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Property Depreciation Rules Schedule Recapture